There's So Much Happening Here

Welcome to

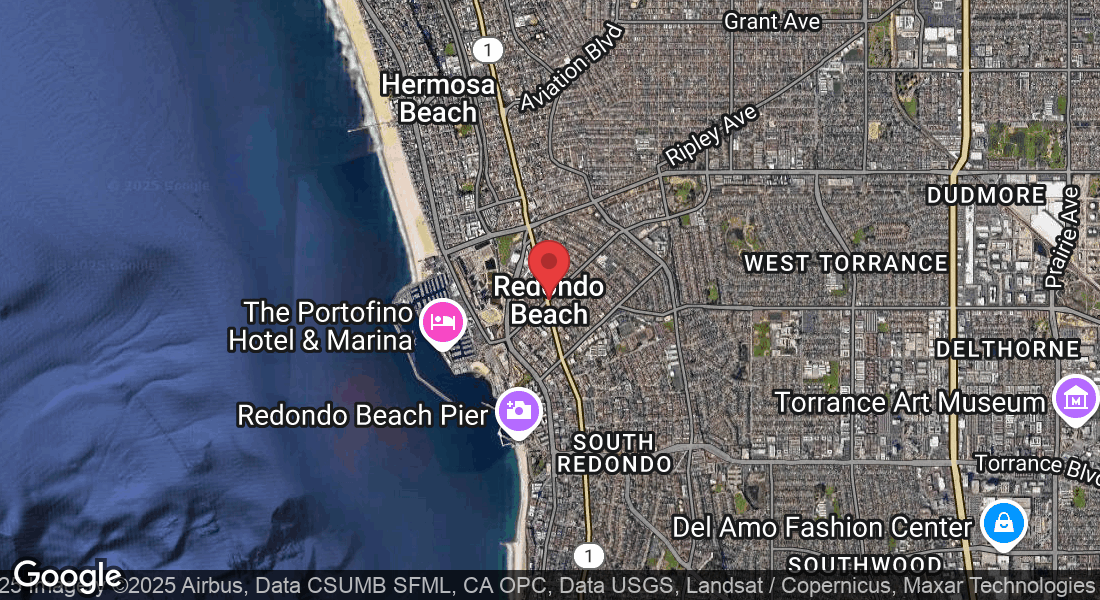

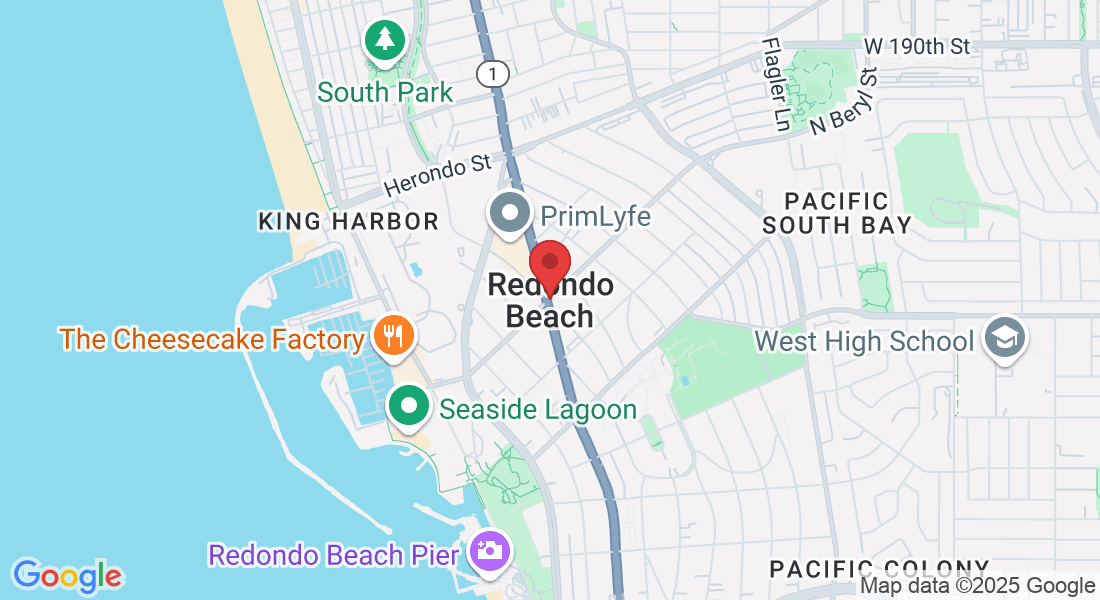

San Diego Neighborhood Experts

There's So Much Happening Here...

LOCAL AMBASSADOR

Thomas J. Nelson

Welcome, my friends, to San Diego Neighborhood Experts, your one-stop shop for all things local! Here, we bring you exclusive interviews with our beloved neighborhood businesses, the latest happenings in San Diego, fresh events to look out for, and of course, juicy tidbits about the ever-exciting real estate market. Stay classy, San Diego!

My mission is to inspire growth and cultivate financial freedom by delivering exceptional real estate services. As a perpetual learner and explorer, I serve others with energy and focus, using pragmatic communication and a global perspective to create deep connections and make a meaningful impact. A treasure hunter at heart, I embrace every opportunity to motivate and empower those I serve and achieve success in all our ventures.

San Diego Neighborhood Experts Podcast

Buying A Home: Beef Up Your Credit Score

Buying A Home: Beef Up Your Credit Score and Manage It Wisely

While cash may seem like king, especially for homebuyers, effective credit management holds more value in the long run. Cash buyers often lowball, assuming their cash has greater worth. While cash transactions eliminate some contingencies, a well-priced home and a qualified buyer can address these just as effectively. Principle buyers often can out negotiate cash investors because homeowners have longfer to recoup their investment and build equity than cash investors do.

Where’s The Beef in Credit Management?

Start by using your credit cards consistently. Keep long-held accounts open and maintain low or zero balances. The key is to make purchases and promptly pay them off, demonstrating responsible credit use and enhancing your score over time. Aim to keep your credit utilization below 30% of your available limit and avoid closing old accounts, as a longer credit history benefits your score. These steps will strengthen your financial profile.

Important: Avoid Using Credit Once Preapproved for a Loan or in Escrow (Under Contract)

Once in escrow, it's crucial to maintain financial stability for a smooth closing process. Here’s why avoiding credit use during this period is essential:

Loan Qualification: Lenders re-evaluate your financial status before closing. New credit inquiries can affect your debt-to-income ratio, risking loan approval.

Credit Score Impact: Applying for new credit can temporarily lower your score, potentially affecting interest rates or loan approval.

Additional Debt Concerns: New debts increase obligations and could imply you can’t afford the mortgage payments. Avoid buying or leasing furniture, appliances, or new cars. Do not co-sign loans during this period.

Changes in Loan Terms: Financial changes may prompt lenders to adjust loan terms, possibly resulting in higher interest rates or less favorable conditions.

Underwriting Red Flags: New credit activity may signal instability, leading to more investigation or loan denial.

Delays in Closing: Complications from credit changes can delay closing, as lenders might need time to reassess.

To avoid these issues:

Refrain from significant financial changes or large purchases (leases) until your home purchase is complete. No new cars, furniture, appliances, or new lines of credit.

Once preapproved for a loan, consult your lender for any purchases over $250.

Additionally, avoid changing jobs or losing employment.

Postpone any out-of-town trips, if possible, while house hunting or in escrow.

Be sure to check in with your lender and REALTOR® since they will properly guide you!

Buying A Home: Beef Up Your Credit Score

Buying A Home: Beef Up Your Credit Score and Manage It Wisely

While cash may seem like king, especially for homebuyers, effective credit management holds more value in the long run. Cash buyers often lowball, assuming their cash has greater worth. While cash transactions eliminate some contingencies, a well-priced home and a qualified buyer can address these just as effectively. Principle buyers often can out negotiate cash investors because homeowners have longfer to recoup their investment and build equity than cash investors do.

Where’s The Beef in Credit Management?

Start by using your credit cards consistently. Keep long-held accounts open and maintain low or zero balances. The key is to make purchases and promptly pay them off, demonstrating responsible credit use and enhancing your score over time. Aim to keep your credit utilization below 30% of your available limit and avoid closing old accounts, as a longer credit history benefits your score. These steps will strengthen your financial profile.

Important: Avoid Using Credit Once Preapproved for a Loan or in Escrow (Under Contract)

Once in escrow, it's crucial to maintain financial stability for a smooth closing process. Here’s why avoiding credit use during this period is essential:

Loan Qualification: Lenders re-evaluate your financial status before closing. New credit inquiries can affect your debt-to-income ratio, risking loan approval.

Credit Score Impact: Applying for new credit can temporarily lower your score, potentially affecting interest rates or loan approval.

Additional Debt Concerns: New debts increase obligations and could imply you can’t afford the mortgage payments. Avoid buying or leasing furniture, appliances, or new cars. Do not co-sign loans during this period.

Changes in Loan Terms: Financial changes may prompt lenders to adjust loan terms, possibly resulting in higher interest rates or less favorable conditions.

Underwriting Red Flags: New credit activity may signal instability, leading to more investigation or loan denial.

Delays in Closing: Complications from credit changes can delay closing, as lenders might need time to reassess.

To avoid these issues:

Refrain from significant financial changes or large purchases (leases) until your home purchase is complete. No new cars, furniture, appliances, or new lines of credit.

Once preapproved for a loan, consult your lender for any purchases over $250.

Additionally, avoid changing jobs or losing employment.

Postpone any out-of-town trips, if possible, while house hunting or in escrow.

Be sure to check in with your lender and REALTOR® since they will properly guide you!

San Diego Neighborhood Experts is a FREE community initiative to help locals get to know each other and encourage everyone to shop local!

Apply to have your business interviewed and featured on the podcast for free!

San Diego Blogs

Buying A Home: Beef Up Your Credit Score

Buying A Home: Beef Up Your Credit Score and Manage It Wisely

While cash may seem like king, especially for homebuyers, effective credit management holds more value in the long run. Cash buyers often lowball, assuming their cash has greater worth. While cash transactions eliminate some contingencies, a well-priced home and a qualified buyer can address these just as effectively. Principle buyers often can out negotiate cash investors because homeowners have longfer to recoup their investment and build equity than cash investors do.

Where’s The Beef in Credit Management?

Start by using your credit cards consistently. Keep long-held accounts open and maintain low or zero balances. The key is to make purchases and promptly pay them off, demonstrating responsible credit use and enhancing your score over time. Aim to keep your credit utilization below 30% of your available limit and avoid closing old accounts, as a longer credit history benefits your score. These steps will strengthen your financial profile.

Important: Avoid Using Credit Once Preapproved for a Loan or in Escrow (Under Contract)

Once in escrow, it's crucial to maintain financial stability for a smooth closing process. Here’s why avoiding credit use during this period is essential:

Loan Qualification: Lenders re-evaluate your financial status before closing. New credit inquiries can affect your debt-to-income ratio, risking loan approval.

Credit Score Impact: Applying for new credit can temporarily lower your score, potentially affecting interest rates or loan approval.

Additional Debt Concerns: New debts increase obligations and could imply you can’t afford the mortgage payments. Avoid buying or leasing furniture, appliances, or new cars. Do not co-sign loans during this period.

Changes in Loan Terms: Financial changes may prompt lenders to adjust loan terms, possibly resulting in higher interest rates or less favorable conditions.

Underwriting Red Flags: New credit activity may signal instability, leading to more investigation or loan denial.

Delays in Closing: Complications from credit changes can delay closing, as lenders might need time to reassess.

To avoid these issues:

Refrain from significant financial changes or large purchases (leases) until your home purchase is complete. No new cars, furniture, appliances, or new lines of credit.

Once preapproved for a loan, consult your lender for any purchases over $250.

Additionally, avoid changing jobs or losing employment.

Postpone any out-of-town trips, if possible, while house hunting or in escrow.

Be sure to check in with your lender and REALTOR® since they will properly guide you!

https://storage.googleapis.com/msgsndr/LGvMHSpjamZ678AUgrJY/media/65ed25120013ad8189925cc4.jpeg

#58BB47

#0000FF

https://storage.googleapis.com/msgsndr/LGvMHSpjamZ678AUgrJY/media/663e5366699c7e1eb628841a.jpeg

https://www.google.com/maps/embed?pb=!1m18!1m12!1m3!1d429155.3376406009!2d-117.43861812897623!3d32.82469764779043!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x80d9530fad921e4b%3A0xd3a21fdfd15df79!2sSan%20Diego%2C%20CA%2C%20USA!5e0!3m2!1sen!2sph!4v1710098235283!5m2!1sen!2sph

Thank you for visiting

San Diego

Contact Info

Address

8895 Towne Centre Dr. Ste 105 PMB 436, San Diego, CA 92122-5542

Phone

+18582328722