San Diego Neighborhood Experts Podcast

Get to know the community with Thomas J. Nelson

San Diego Neighborhood Experts Podcast

Get to know the community with Thomas J. Nelson

Watch All The Episodes Below

Business Spotlight

Stay up to date with everything going on

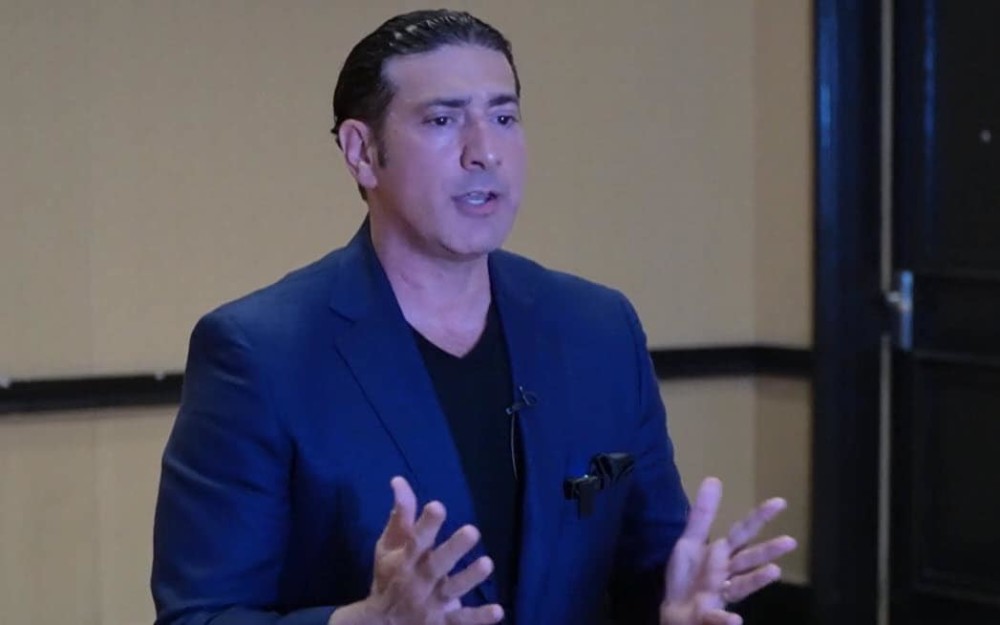

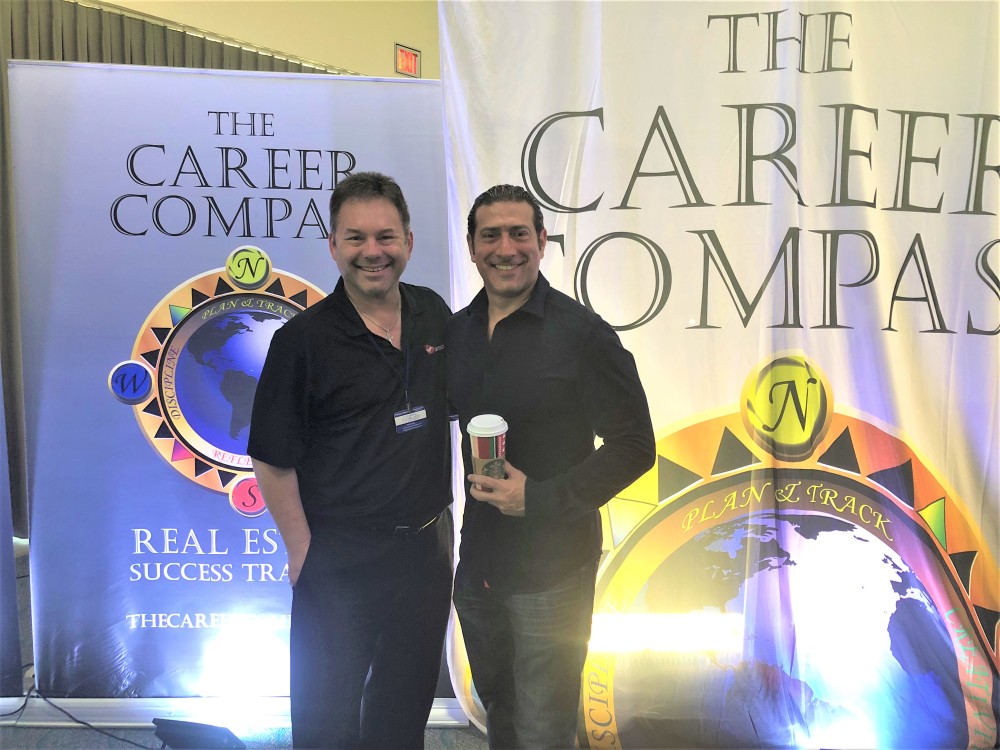

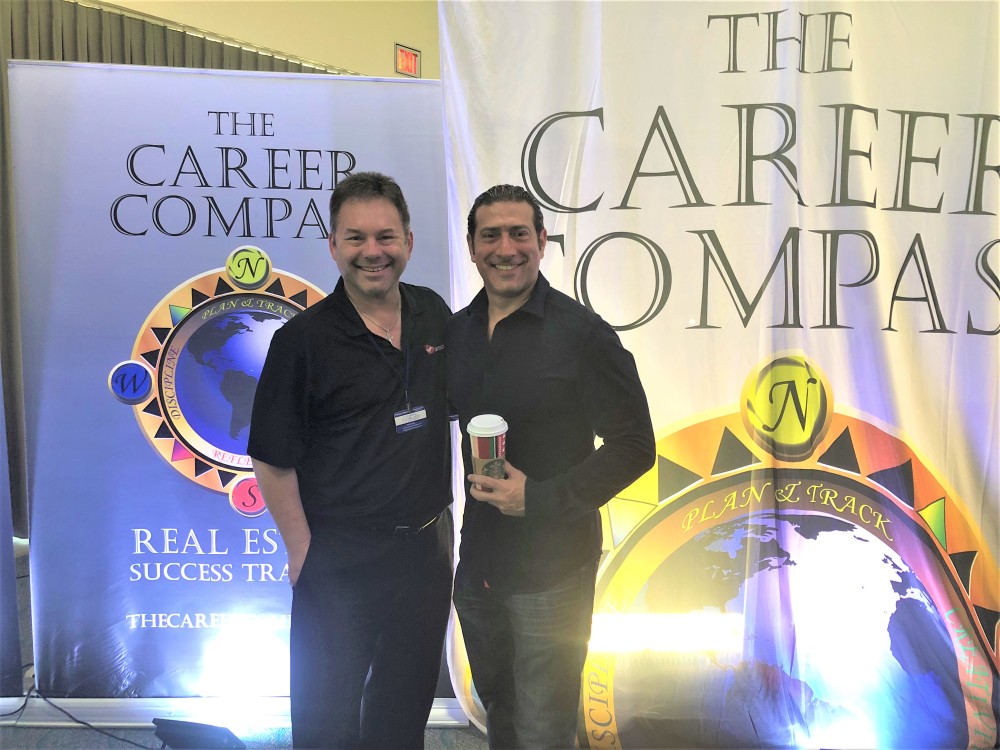

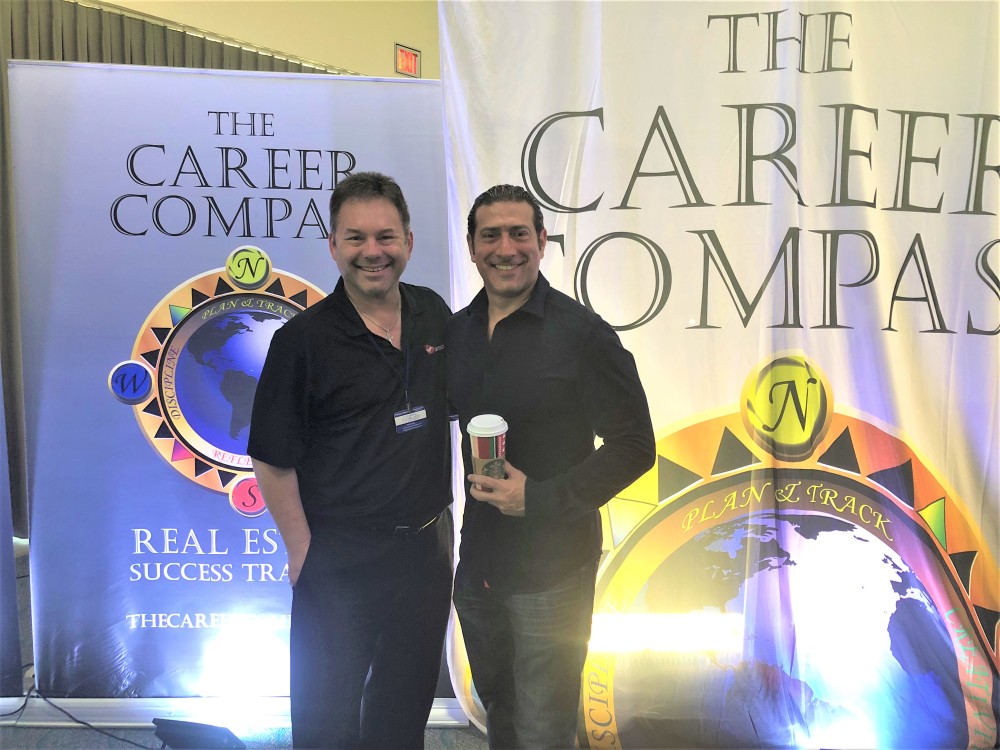

Mortgage Lender Serving Bay Park - San Diego; In Fact all 50 States!

Jason Gordon was lender with Amerifirst Financial at the time of this interview.

Since then he's upgraded to a much better company, CMG Home Loans. I've been experiencing an even more robust peripheral suite of bells and whistles from CMG as a REALTOR® and the same level of excellence that makes me follow the man, not the company. I've updated his contact info below.

Also please be advised that any programs discussed in the video were limited to the previous company and are not applicable to CMG, but CMG offers a plethora of amazing programs. You can talk to Jason about directly!

Jason E. Gordon is my #1 Lender and has become a friend over the 16 years+ we've been working together. Jason and I sat in the backyard of my Bay Park home that he helped me purchase and we discuss the myths and misconceptions of shopping mortgage rates, choosing a lender and comparing fees. We also get into some of the great reasons you'll hear for yourself, why working with direct lenders like Jason Gordon give you better options and save you money up front and over time.

Jason has provided both my clients and I with refinancing on existing homes, conventional loans for our purchases and for my Veterans: VA Loans 0% down and my low down payment buyers: FHA loans 3.5% down. Jason also offers the unique PYT Program (protect your transaction) and the Cash Is King opportunity to sell your home after you buy your new home. Yes! Buy first, sell later!

(Please see Jason's contact info at the end of this post).

Why did you become a mortgage lender?

Unlike most Mortgage Lenders who entered the market via an “Inbound Call Center” I spent nearly a decade in the Banking Industry. As with most “branch Bankers” you are taught “a little bit about a lot of things, but not too much about any one thing” (in other words, I was taught a little bit about Consumer Banking, Business Banking, Savings & Investments, and Lending…I was a true “Jack of all trades, master of none”). Intuitively, I knew if I wanted to meet my career goals, I needed to specialize in one of those topics…I chose mortgage lending.

Not all Mortgage Professionals are alike, and it is easy to prove. In fact, I’ll give you a simple experiment you can do independently. When you are shopping Loan Officers, simply Google their first name + last name + the word MORTGAGE. For example, Google “Jason Gordon Mortgage” and see what you can find about that professional. The true Relational Mortgage Professionals are easy to research, well connected in the community, and accountable for their actions. Does your Mortgage Lender have a Yelp profile? If not, ask yourself why.

What is the most memorable experience you've had so far?

Although I help all types of clients (regardless of their marital status), I have a special niche in helping Divorcing Homeowners. As I’m sure you can imagine, these are very delicate & emotional cases more often than not, and typically the most difficult loans to complete. A couple years ago, I helped a woman save her home amidst a contentious divorce. She was an ongoing victim of domestic violence and battered not just physically, but emotionally. In fact, we had to send a Notary to the local prison to get signatures from her ex-husband who was in jail for the abuse. Suffice to say, helping fellow humans through challenging transitions in their lives is an intrinsic benefit of my job on an ongoing basis.

What are your greatest challenges?

Sadly, we Lenders have become commoditized over the years. Many Consumers think we are all essentially Swap Meet Vendors all selling the same gadget, and that they can simply choose the cheapest. Unfortunately, the vast majority do not know what truly goes into a mortgage quote, and they simply assume that the company advertising on the radio or television must be the cheapest, or they simply gravitate to their bank and assume they will get special pricing because they have a checking account with this Bank.

What do you do for fun?

I love doing fun things with fun people. Whether that fun be amidst road trips or local in America’s Finest City, I thoroughly enjoy concerts, sporting events, nature, and of course a good meal. That said, I am equally as happy hanging out at home with my wife and 3 furry family members.

What Should Borrowers Consider When Shopping Lenders and Loan Products/Fees/Rates?

The golden rule of economics is that “there is no such thing as a free lunch” and those who understand that concept realize that there is no “magic bank” giving away free mortgages. We all operate the same way behind the curtain when it comes to interest rates & closing costs. The rule of thumb is that “the more you pay in costs, the less you pay in interest rate, and vice versa.” All Banks, Mortgage Lenders, Brokers and Credit Unions operate on that same formula.

Once you can move past these myths, it is easier to understand the difference between a TRANSACTIONAL Mortgage Professional and a RELATIONAL Mortgage Professional. In short, most Loan Officers begin their careers at a Transactional “inbound call center” Mortgage Company. The reasons are simple…the company is providing you leads and as a newbie, you know you’re going to make plenty of mistakes…and you’d much rather make a mistake with a client who is 2000 miles away as opposed to messing up the loan for your Mother’s best friend who is buying a home. Transactional mortgage professionals are ranked on their lead conversion, so it behooves them to say whatever is necessary to get you to apply in order to keep their job. A Relational mortgage professional acts in the capacity of a Trusted Advisor and works with other relationship based professionals such as CPA’s, Financial Planners, Attorneys, and Real Estate Agents like yourself. We Relational Mortgage Professionals must be accountable for each and every word we say or action we complete.

What is the best way for customers to contact you?

Jason Gordon

Loan Officer

1033 B Ave. #105, Coronado, CA 92118

APPLY NOW | MYSITE | DOC UPLOAD

NMLS# 259027 | BRANCH NMLS# 920781 | CORPORATE NMLS# 1820

SIMPLIFIED. TRUSTED. COMMITTED.

5 25 Reviews >

5 125 Reviews >

Mobile: 619.200.8031

www.GordonMortgage.com

Electronic Business Card: www.VIPBorrower.com

https://www.facebook.com/JasonGordonMortgage

#58BB47

#0000FF

https://www.google.com/maps/embed?pb=!1m18!1m12!1m3!1d429155.3376406009!2d-117.43861812897623!3d32.82469764779043!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x80d9530fad921e4b%3A0xd3a21fdfd15df79!2sSan%20Diego%2C%20CA%2C%20USA!5e0!3m2!1sen!2sph!4v1710098235283!5m2!1sen!2sph

Thank you for visiting

San Diego

Contact Info

Address

8895 Towne Centre Dr. Ste 105 PMB 436, San Diego, CA 92122-5542

Phone

+18582328722

Interviews

Mortgage Lender Serving Bay Park - San Diego; In Fact all 50 States!

Jason Gordon was lender with Amerifirst Financial at the time of this interview.

Since then he's upgraded to a much better company, CMG Home Loans. I've been experiencing an even more robust peripheral suite of bells and whistles from CMG as a REALTOR® and the same level of excellence that makes me follow the man, not the company. I've updated his contact info below.

Also please be advised that any programs discussed in the video were limited to the previous company and are not applicable to CMG, but CMG offers a plethora of amazing programs. You can talk to Jason about directly!

Jason E. Gordon is my #1 Lender and has become a friend over the 16 years+ we've been working together. Jason and I sat in the backyard of my Bay Park home that he helped me purchase and we discuss the myths and misconceptions of shopping mortgage rates, choosing a lender and comparing fees. We also get into some of the great reasons you'll hear for yourself, why working with direct lenders like Jason Gordon give you better options and save you money up front and over time.

Jason has provided both my clients and I with refinancing on existing homes, conventional loans for our purchases and for my Veterans: VA Loans 0% down and my low down payment buyers: FHA loans 3.5% down. Jason also offers the unique PYT Program (protect your transaction) and the Cash Is King opportunity to sell your home after you buy your new home. Yes! Buy first, sell later!

(Please see Jason's contact info at the end of this post).

Why did you become a mortgage lender?

Unlike most Mortgage Lenders who entered the market via an “Inbound Call Center” I spent nearly a decade in the Banking Industry. As with most “branch Bankers” you are taught “a little bit about a lot of things, but not too much about any one thing” (in other words, I was taught a little bit about Consumer Banking, Business Banking, Savings & Investments, and Lending…I was a true “Jack of all trades, master of none”). Intuitively, I knew if I wanted to meet my career goals, I needed to specialize in one of those topics…I chose mortgage lending.

Not all Mortgage Professionals are alike, and it is easy to prove. In fact, I’ll give you a simple experiment you can do independently. When you are shopping Loan Officers, simply Google their first name + last name + the word MORTGAGE. For example, Google “Jason Gordon Mortgage” and see what you can find about that professional. The true Relational Mortgage Professionals are easy to research, well connected in the community, and accountable for their actions. Does your Mortgage Lender have a Yelp profile? If not, ask yourself why.

What is the most memorable experience you've had so far?

Although I help all types of clients (regardless of their marital status), I have a special niche in helping Divorcing Homeowners. As I’m sure you can imagine, these are very delicate & emotional cases more often than not, and typically the most difficult loans to complete. A couple years ago, I helped a woman save her home amidst a contentious divorce. She was an ongoing victim of domestic violence and battered not just physically, but emotionally. In fact, we had to send a Notary to the local prison to get signatures from her ex-husband who was in jail for the abuse. Suffice to say, helping fellow humans through challenging transitions in their lives is an intrinsic benefit of my job on an ongoing basis.

What are your greatest challenges?

Sadly, we Lenders have become commoditized over the years. Many Consumers think we are all essentially Swap Meet Vendors all selling the same gadget, and that they can simply choose the cheapest. Unfortunately, the vast majority do not know what truly goes into a mortgage quote, and they simply assume that the company advertising on the radio or television must be the cheapest, or they simply gravitate to their bank and assume they will get special pricing because they have a checking account with this Bank.

What do you do for fun?

I love doing fun things with fun people. Whether that fun be amidst road trips or local in America’s Finest City, I thoroughly enjoy concerts, sporting events, nature, and of course a good meal. That said, I am equally as happy hanging out at home with my wife and 3 furry family members.

What Should Borrowers Consider When Shopping Lenders and Loan Products/Fees/Rates?

The golden rule of economics is that “there is no such thing as a free lunch” and those who understand that concept realize that there is no “magic bank” giving away free mortgages. We all operate the same way behind the curtain when it comes to interest rates & closing costs. The rule of thumb is that “the more you pay in costs, the less you pay in interest rate, and vice versa.” All Banks, Mortgage Lenders, Brokers and Credit Unions operate on that same formula.

Once you can move past these myths, it is easier to understand the difference between a TRANSACTIONAL Mortgage Professional and a RELATIONAL Mortgage Professional. In short, most Loan Officers begin their careers at a Transactional “inbound call center” Mortgage Company. The reasons are simple…the company is providing you leads and as a newbie, you know you’re going to make plenty of mistakes…and you’d much rather make a mistake with a client who is 2000 miles away as opposed to messing up the loan for your Mother’s best friend who is buying a home. Transactional mortgage professionals are ranked on their lead conversion, so it behooves them to say whatever is necessary to get you to apply in order to keep their job. A Relational mortgage professional acts in the capacity of a Trusted Advisor and works with other relationship based professionals such as CPA’s, Financial Planners, Attorneys, and Real Estate Agents like yourself. We Relational Mortgage Professionals must be accountable for each and every word we say or action we complete.

What is the best way for customers to contact you?

Jason Gordon

Loan Officer

1033 B Ave. #105, Coronado, CA 92118

APPLY NOW | MYSITE | DOC UPLOAD

NMLS# 259027 | BRANCH NMLS# 920781 | CORPORATE NMLS# 1820

SIMPLIFIED. TRUSTED. COMMITTED.

5 25 Reviews >

5 125 Reviews >

Mobile: 619.200.8031

www.GordonMortgage.com

Electronic Business Card: www.VIPBorrower.com

https://www.facebook.com/JasonGordonMortgage

Articles

Mortgage Lender Serving Bay Park - San Diego; In Fact all 50 States!

Jason Gordon was lender with Amerifirst Financial at the time of this interview.

Since then he's upgraded to a much better company, CMG Home Loans. I've been experiencing an even more robust peripheral suite of bells and whistles from CMG as a REALTOR® and the same level of excellence that makes me follow the man, not the company. I've updated his contact info below.

Also please be advised that any programs discussed in the video were limited to the previous company and are not applicable to CMG, but CMG offers a plethora of amazing programs. You can talk to Jason about directly!

Jason E. Gordon is my #1 Lender and has become a friend over the 16 years+ we've been working together. Jason and I sat in the backyard of my Bay Park home that he helped me purchase and we discuss the myths and misconceptions of shopping mortgage rates, choosing a lender and comparing fees. We also get into some of the great reasons you'll hear for yourself, why working with direct lenders like Jason Gordon give you better options and save you money up front and over time.

Jason has provided both my clients and I with refinancing on existing homes, conventional loans for our purchases and for my Veterans: VA Loans 0% down and my low down payment buyers: FHA loans 3.5% down. Jason also offers the unique PYT Program (protect your transaction) and the Cash Is King opportunity to sell your home after you buy your new home. Yes! Buy first, sell later!

(Please see Jason's contact info at the end of this post).

Why did you become a mortgage lender?

Unlike most Mortgage Lenders who entered the market via an “Inbound Call Center” I spent nearly a decade in the Banking Industry. As with most “branch Bankers” you are taught “a little bit about a lot of things, but not too much about any one thing” (in other words, I was taught a little bit about Consumer Banking, Business Banking, Savings & Investments, and Lending…I was a true “Jack of all trades, master of none”). Intuitively, I knew if I wanted to meet my career goals, I needed to specialize in one of those topics…I chose mortgage lending.

Not all Mortgage Professionals are alike, and it is easy to prove. In fact, I’ll give you a simple experiment you can do independently. When you are shopping Loan Officers, simply Google their first name + last name + the word MORTGAGE. For example, Google “Jason Gordon Mortgage” and see what you can find about that professional. The true Relational Mortgage Professionals are easy to research, well connected in the community, and accountable for their actions. Does your Mortgage Lender have a Yelp profile? If not, ask yourself why.

What is the most memorable experience you've had so far?

Although I help all types of clients (regardless of their marital status), I have a special niche in helping Divorcing Homeowners. As I’m sure you can imagine, these are very delicate & emotional cases more often than not, and typically the most difficult loans to complete. A couple years ago, I helped a woman save her home amidst a contentious divorce. She was an ongoing victim of domestic violence and battered not just physically, but emotionally. In fact, we had to send a Notary to the local prison to get signatures from her ex-husband who was in jail for the abuse. Suffice to say, helping fellow humans through challenging transitions in their lives is an intrinsic benefit of my job on an ongoing basis.

What are your greatest challenges?

Sadly, we Lenders have become commoditized over the years. Many Consumers think we are all essentially Swap Meet Vendors all selling the same gadget, and that they can simply choose the cheapest. Unfortunately, the vast majority do not know what truly goes into a mortgage quote, and they simply assume that the company advertising on the radio or television must be the cheapest, or they simply gravitate to their bank and assume they will get special pricing because they have a checking account with this Bank.

What do you do for fun?

I love doing fun things with fun people. Whether that fun be amidst road trips or local in America’s Finest City, I thoroughly enjoy concerts, sporting events, nature, and of course a good meal. That said, I am equally as happy hanging out at home with my wife and 3 furry family members.

What Should Borrowers Consider When Shopping Lenders and Loan Products/Fees/Rates?

The golden rule of economics is that “there is no such thing as a free lunch” and those who understand that concept realize that there is no “magic bank” giving away free mortgages. We all operate the same way behind the curtain when it comes to interest rates & closing costs. The rule of thumb is that “the more you pay in costs, the less you pay in interest rate, and vice versa.” All Banks, Mortgage Lenders, Brokers and Credit Unions operate on that same formula.

Once you can move past these myths, it is easier to understand the difference between a TRANSACTIONAL Mortgage Professional and a RELATIONAL Mortgage Professional. In short, most Loan Officers begin their careers at a Transactional “inbound call center” Mortgage Company. The reasons are simple…the company is providing you leads and as a newbie, you know you’re going to make plenty of mistakes…and you’d much rather make a mistake with a client who is 2000 miles away as opposed to messing up the loan for your Mother’s best friend who is buying a home. Transactional mortgage professionals are ranked on their lead conversion, so it behooves them to say whatever is necessary to get you to apply in order to keep their job. A Relational mortgage professional acts in the capacity of a Trusted Advisor and works with other relationship based professionals such as CPA’s, Financial Planners, Attorneys, and Real Estate Agents like yourself. We Relational Mortgage Professionals must be accountable for each and every word we say or action we complete.

What is the best way for customers to contact you?

Jason Gordon

Loan Officer

1033 B Ave. #105, Coronado, CA 92118

APPLY NOW | MYSITE | DOC UPLOAD

NMLS# 259027 | BRANCH NMLS# 920781 | CORPORATE NMLS# 1820

SIMPLIFIED. TRUSTED. COMMITTED.

5 25 Reviews >

5 125 Reviews >

Mobile: 619.200.8031

www.GordonMortgage.com

Electronic Business Card: www.VIPBorrower.com

https://www.facebook.com/JasonGordonMortgage