There's So Much Happening Here

Welcome to

San Diego Neighborhood Experts

There's So Much Happening Here...

LOCAL AMBASSADOR

Thomas J. Nelson

Welcome, my friends, to San Diego Neighborhood Experts, your one-stop shop for all things local! Here, we bring you exclusive interviews with our beloved neighborhood businesses, the latest happenings in San Diego, fresh events to look out for, and of course, juicy tidbits about the ever-exciting real estate market. Stay classy, San Diego!

My mission is to inspire growth and cultivate financial freedom by delivering exceptional real estate services. As a perpetual learner and explorer, I serve others with energy and focus, using pragmatic communication and a global perspective to create deep connections and make a meaningful impact. A treasure hunter at heart, I embrace every opportunity to motivate and empower those I serve and achieve success in all our ventures.

San Diego Neighborhood Experts Podcast

Too Much Cash To Crash

There is Fake News circulating social media right now, (shocker!), so lets dispel the rumors and shine a light on the truth. The US housing market is experiencing fluctuations, but a crash is not anticipated, and here's why:

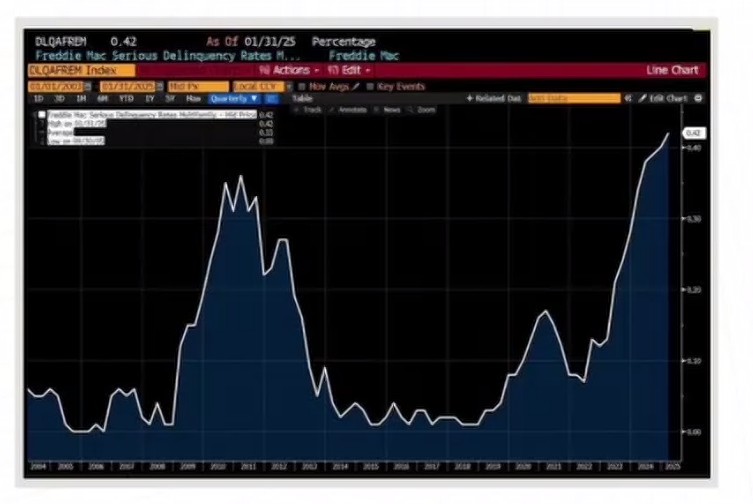

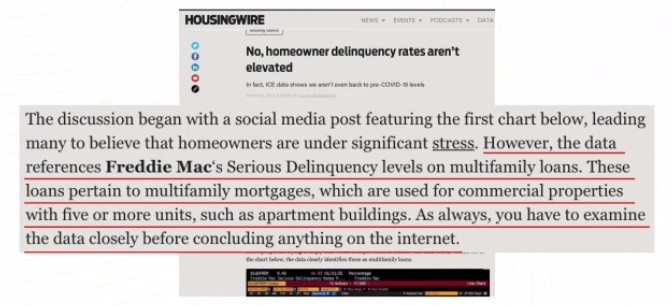

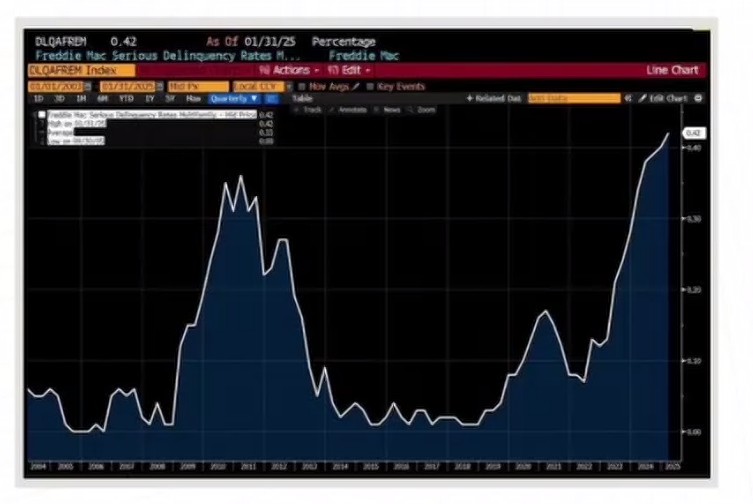

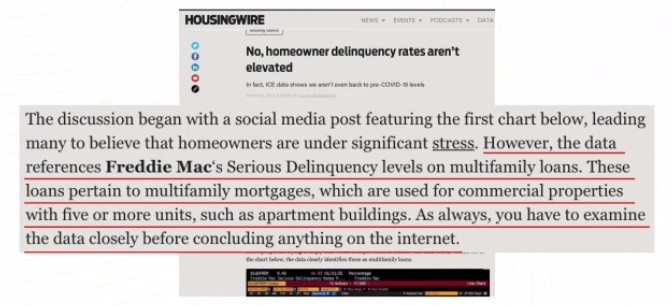

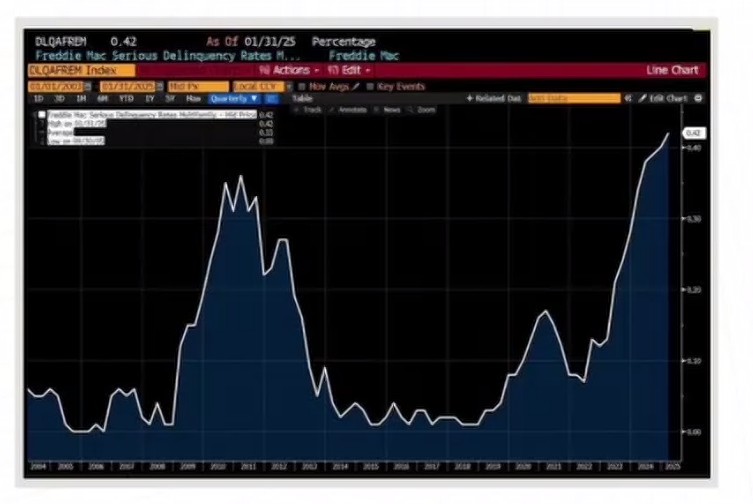

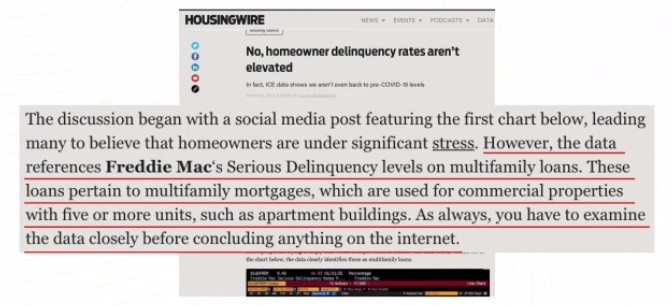

This is the chart being passed around the internet:

Look pretty ominous doesn't it? Except that this is a multi-family chart - apartment buildings and larger commercial properties, not the residential properties.

Delinquency Rates:

The delinquency rate for multi-family properties is relatively low at 0.4%. Although this is an increase from 0.1%, it's important to note that a rise in delinquency rates is anticipated due to various external factors.

Foreclosures are a regular part of the real estate sector and help maintain balance.

FHA Loans:

There's been an increase in FHA loans since 2007, reflecting the growing accessibility of these loans. This elevation accounts for more borrowers with FHA loans in 2025, and the higher delinquency rate partly reflects natural disaster forbearance options. Instances of hurricanes, fires, and flooding contribute to temporary deferments, which are marked as delinquencies, inflating the numbers superficially.

FHA loans, often used by lower-income borrowers, face higher default risks due to economic pressures. However, these are managed through structured forbearance programs.

As you can see, with more FHA loans than 2007, we have less delinquencies

and many are called "delinquent" despite having lender approved forbearance.

Current Delinquency Trends:

About 3.9% of loans are delinquent for less than 90 days, with only 1.19% classified as seriously delinquent. These numbers are far from those experienced during the subprime mortgage crisis.

Equity and Foreclosure:

Homeowners should consider their options, such as unlocking equity if they face financial difficulties. Selling a property before it reaches the foreclosure stage can provide financial relief and the opportunity for a fresh start.

When you compare 2024's 1.19% serious delinquency (over 90 days) to 2007's of 25%

you start to realize that we're in a tough, but good market, with over 55% of the homeowners owning 50% or greater equity in their homes.

The overall health of the housing market today benefits from stronger regulatory frameworks, better lending practices, and a more robust economic environment compared to the lead-up to the 2007-2008 crash. Therefore, while challenges exist, they are manageable within the current economic landscape.

Too Much Cash To Crash

There is Fake News circulating social media right now, (shocker!), so lets dispel the rumors and shine a light on the truth. The US housing market is experiencing fluctuations, but a crash is not anticipated, and here's why:

This is the chart being passed around the internet:

Look pretty ominous doesn't it? Except that this is a multi-family chart - apartment buildings and larger commercial properties, not the residential properties.

Delinquency Rates:

The delinquency rate for multi-family properties is relatively low at 0.4%. Although this is an increase from 0.1%, it's important to note that a rise in delinquency rates is anticipated due to various external factors.

Foreclosures are a regular part of the real estate sector and help maintain balance.

FHA Loans:

There's been an increase in FHA loans since 2007, reflecting the growing accessibility of these loans. This elevation accounts for more borrowers with FHA loans in 2025, and the higher delinquency rate partly reflects natural disaster forbearance options. Instances of hurricanes, fires, and flooding contribute to temporary deferments, which are marked as delinquencies, inflating the numbers superficially.

FHA loans, often used by lower-income borrowers, face higher default risks due to economic pressures. However, these are managed through structured forbearance programs.

As you can see, with more FHA loans than 2007, we have less delinquencies

and many are called "delinquent" despite having lender approved forbearance.

Current Delinquency Trends:

About 3.9% of loans are delinquent for less than 90 days, with only 1.19% classified as seriously delinquent. These numbers are far from those experienced during the subprime mortgage crisis.

Equity and Foreclosure:

Homeowners should consider their options, such as unlocking equity if they face financial difficulties. Selling a property before it reaches the foreclosure stage can provide financial relief and the opportunity for a fresh start.

When you compare 2024's 1.19% serious delinquency (over 90 days) to 2007's of 25%

you start to realize that we're in a tough, but good market, with over 55% of the homeowners owning 50% or greater equity in their homes.

The overall health of the housing market today benefits from stronger regulatory frameworks, better lending practices, and a more robust economic environment compared to the lead-up to the 2007-2008 crash. Therefore, while challenges exist, they are manageable within the current economic landscape.

San Diego Neighborhood Experts is a FREE community initiative to help locals get to know each other and encourage everyone to shop local!

Apply to have your business interviewed and featured on the podcast for free!

San Diego Blogs

Too Much Cash To Crash

There is Fake News circulating social media right now, (shocker!), so lets dispel the rumors and shine a light on the truth. The US housing market is experiencing fluctuations, but a crash is not anticipated, and here's why:

This is the chart being passed around the internet:

Look pretty ominous doesn't it? Except that this is a multi-family chart - apartment buildings and larger commercial properties, not the residential properties.

Delinquency Rates:

The delinquency rate for multi-family properties is relatively low at 0.4%. Although this is an increase from 0.1%, it's important to note that a rise in delinquency rates is anticipated due to various external factors.

Foreclosures are a regular part of the real estate sector and help maintain balance.

FHA Loans:

There's been an increase in FHA loans since 2007, reflecting the growing accessibility of these loans. This elevation accounts for more borrowers with FHA loans in 2025, and the higher delinquency rate partly reflects natural disaster forbearance options. Instances of hurricanes, fires, and flooding contribute to temporary deferments, which are marked as delinquencies, inflating the numbers superficially.

FHA loans, often used by lower-income borrowers, face higher default risks due to economic pressures. However, these are managed through structured forbearance programs.

As you can see, with more FHA loans than 2007, we have less delinquencies

and many are called "delinquent" despite having lender approved forbearance.

Current Delinquency Trends:

About 3.9% of loans are delinquent for less than 90 days, with only 1.19% classified as seriously delinquent. These numbers are far from those experienced during the subprime mortgage crisis.

Equity and Foreclosure:

Homeowners should consider their options, such as unlocking equity if they face financial difficulties. Selling a property before it reaches the foreclosure stage can provide financial relief and the opportunity for a fresh start.

When you compare 2024's 1.19% serious delinquency (over 90 days) to 2007's of 25%

you start to realize that we're in a tough, but good market, with over 55% of the homeowners owning 50% or greater equity in their homes.

The overall health of the housing market today benefits from stronger regulatory frameworks, better lending practices, and a more robust economic environment compared to the lead-up to the 2007-2008 crash. Therefore, while challenges exist, they are manageable within the current economic landscape.

https://storage.googleapis.com/msgsndr/LGvMHSpjamZ678AUgrJY/media/65ed25120013ad8189925cc4.jpeg

#58BB47

#0000FF

https://storage.googleapis.com/msgsndr/LGvMHSpjamZ678AUgrJY/media/663e5366699c7e1eb628841a.jpeg

https://www.google.com/maps/embed?pb=!1m18!1m12!1m3!1d429155.3376406009!2d-117.43861812897623!3d32.82469764779043!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x80d9530fad921e4b%3A0xd3a21fdfd15df79!2sSan%20Diego%2C%20CA%2C%20USA!5e0!3m2!1sen!2sph!4v1710098235283!5m2!1sen!2sph

Thank you for visiting

San Diego

Contact Info

Address

8895 Towne Centre Dr. Ste 105 PMB 436, San Diego, CA 92122-5542

Phone

+18582328722